Clover Station Duo

Get setup fast with access to amazing apps to take orders from your customers wherever they find you. Upgrade your POS to a Clover Station Duo today!

Learn MoreClover Mini

With all the functionality of a Clover Station packed into one sleek package, your retail shop will be set up with the newest technology for contactless and online orders.

Learn MoreClover Flex Payments

Accept most types of payments anywhere you have a Wi-Fi or cellular connection: contactless, chip, and swipe, including Apple Pay®, Samsung Pay®, and Google Pay®.

Learn More

Terminal Solutions

Seamless Payment Terminals—Yours Free with Online Orders

Upgrade Your Business with Payment Terminals That Work as Hard as You Do

Running a business is challenging enough—your payment systems shouldn't be. That's why we provide state-of-the-art payment terminals designed to make transactions faster, easier, and hassle-free.

The best part? They're FREE when you order online today!

Why Our Payment Terminals Are a Game-Changer

Effortless Setup From unboxing to your first transaction, our terminals are ready to go in minutes—no technical expertise required.

Sleek and Reliable Design Enjoy smooth transactions with modern, user-friendly technology that your customers will love.

All-in-One Functionality Accept credit, debit, contactless payments, and more—because your business deserves flexibility.

Integrations

Infinity Payment Systems connects with top POS systems and business software—plus 100+ additional platforms. Whether you run a restaurant, retail shop, or service business, our solutions integrate with the tools you trust. Don’t see your system listed? Contact us to explore more integration options!

.png)

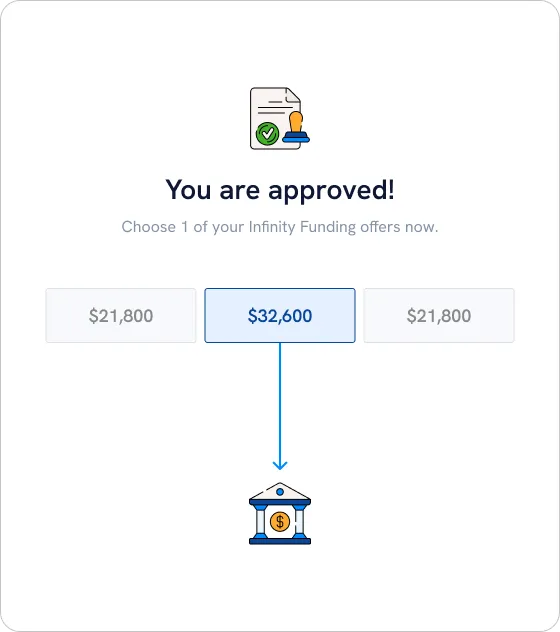

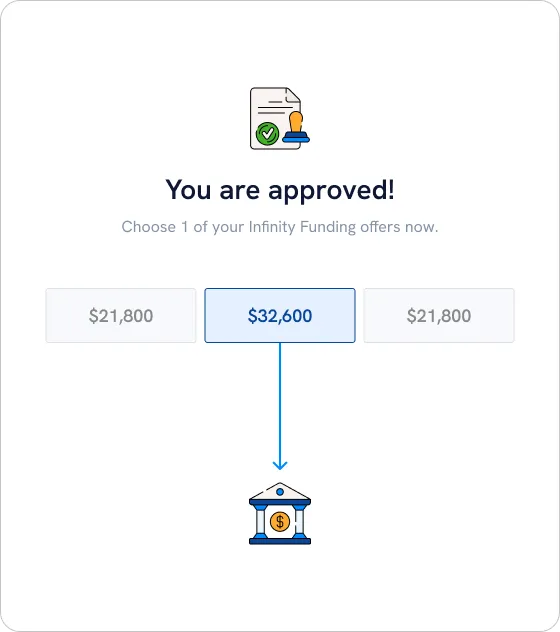

INFINITY FUNDING

Rapid, hassle-free access to the necessary funds. Convert future credit card revenue into immediate working funds, providing lease and startup reimbursement terms to facilitate your business growth. Elevate your business instantly with access to immediate funds—just create a new account and start processing card payments, unlocking endless possibilities.

Quick Approval

Apply faster than you would for traditional loans. Approvals typically take 1-2 business days.

Fast Funding

Once approved, you'll see your working capital in your account in just 2-3 business days.

.png)

Easy Payback

Payments are a fixed percentage of sales—not a fixed amount—so you pay more when your sales are strong and less if sales slow down.

.png)

.png)